Web Wallet

Launch now

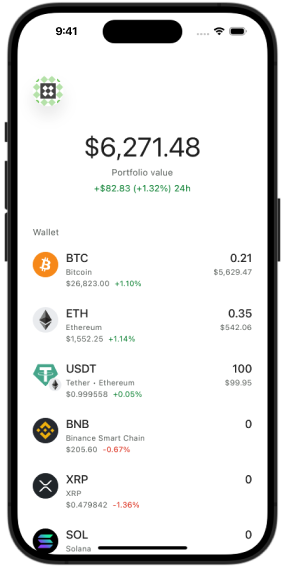

Trusted by millions of users, over 24 million wallets created in 27 languages in 190 countries, Coin Wallet is the most popular and secure non-custodial multicurrency wallet.

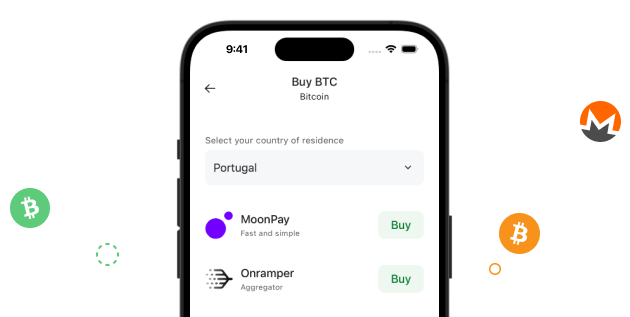

No centralization. You can send your cryptocurrency from anywhere, to anywhere.

Transactions are done instantaneously. No more waiting!

Strong encryption guarantees the highest level of security.

A single wallet to manage all of your crypto on multiple blockchains seamlessly, with multiple platforms supported.

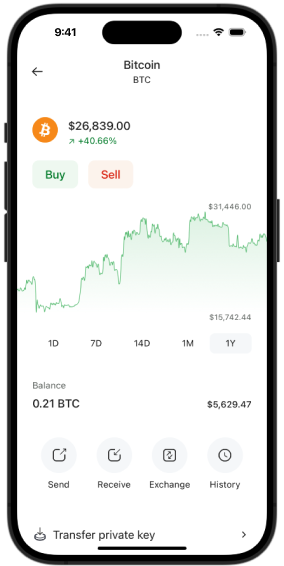

Coin Wallet is intuitive, easy to understand, and packed with tons of useful features.

Coin Wallet puts security and anonymity of users first. That’s why we audited our system to ensure complete data integrity. Our key principles: