The Rise of Digital Banking

Digital banking is another term that is given to the increased popularity and development of online banking services. Digital banking has been developed and implemented by institutions worldwide in an effort to address some of the major shortcomings of traditional banking systems, such as a lack of customer service, lack of convenience for customers and poor access to certain financial services. Furthermore, the uptick in digital banking has given rise to a different type of banking, namely, cryptocurrency banking which has, in turn, increased the adoption of cryptocurrencies as a form of payment.

The earliest implementation of digital banking was longer ago than many people may initially realize, with the advent of digital banking services such as ATMs for cash and bank cards being issued in the 1950s-1960s. By the 1990s, online banking had slingshotted to major popularity in the developed world due to the rise of the internet.

Why is Digital Banking On The Rise?

Convenience

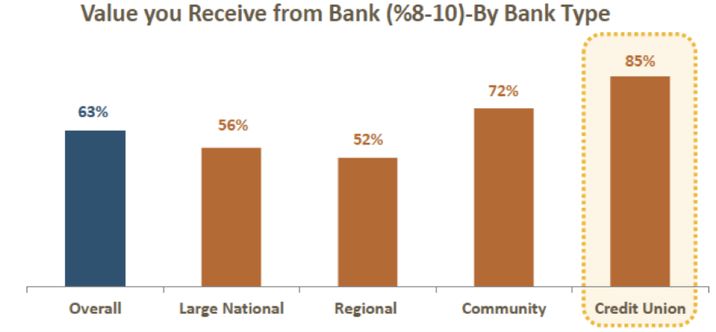

One of the ways in which digital banking has changed the banking sector is by increasing the level of convenience to the customer. In fact, 43% of people have stated that they believe convenience and having effective online services go hand in hand. In the United States, customers have ranked which institutions are the best at promoting access to digital services, and they were ranked according to the below image.

In the United Kingdom, there has been a noticeable rise in the number of and the success of “challenger banks”. These are banks that have no physical branches and all interactions with customers are handled digitally, some have 24/7 telephone customer service. The main reasons for these changes are that people in the United Kingdom are looking for quicker, more convenient banking options.

Savings on Infrastructure and Business Costs

One way in which the move towards digitization can positively affect the businesses in the banking sector is the potential for such a move to promote cost-savings as a result of making operational procedures more streamlined. This also allows banking providers to utilize the funds freed up from cost savings to provide better services to customers, such as by reducing fees for customers.

Digitization can also benefit both the business and the customer due to the fact that it allows for simplification of the onboarding process. A real example of where this has been implemented can be seen from US-based Mariner Bank, who have implemented SaaS from Digital Onboarding, to allow their staff to spend less time filling in forms and therefore spend more time on personally serving customers who require assistance.

How Does Digital Banking Relate to Cryptocurrencies?

Cryptocurrencies have cut a disruptive and controversial figure in the world of finance, since their rise to popularity in 2017, and due to the fact that they are digital assets, they are beginning to form an interesting relationship to the current digital banking landscape.

One of the reasons for the slight change of heart in relation to cryptocurrencies has been the gradual relaxing of cryptocurrency regulations in certain states. Previously, bans on cryptocurrency activities were common, which prevented the symbiotic growth between digital banking and cryptocurrencies.

Some of the behemoths of the financial sector are starting to embrace cryptocurrencies and recognize the value that they could bring to their organization. JP Morgan, for example, has created its own digital currency, with the primary objective of decreasing the amount of time it takes for money to be transferred between two parties. Furthermore, the banking giant claims that it will allow them to facilitate transfers over different blockchains, with the company claiming they have always seen the potential in digital currencies.

Digital banking has helped to spawn a new type of bank, the cryptocurrency bank. Whilst a cryptocurrency bank may sound complicated, they are in fact simply institutions that fulfill the same functions as a normal digital bank would, however, there is one key difference. True to their name, these types of banks include cryptocurrency-related services as a part of their repertoire for their customers.

There has even been a huge rise in the number of cryptocurrency ATMs available to customers for use.

How Will This Change Impact Cryptocurrency Banking?

The rise of digital banking has and will continue to have a positive effect on the viability and the utility of cryptocurrency banking, despite the fact that we are still quite far away from mainstream adoption.

In 2020, 153 Million unique Bitcoin wallet addresses are in circulation, with the number of active wallets being around 550,000. Whereas in February 2019, there were 32 Million Bitcoin wallet addresses, which poses an increase of 121 Million wallets since then.

Cryptocurrency banking does also faces intense challenges for the future. In its current state, the cryptocurrency banking system is slightly ill-fitted for purpose, although progress is always being made. Threats from the traditional banking sector and the continuing volatility of the regulatory landscape relating to cryptocurrencies present significant hurdles to widespread adoption. It is strongly believed that cryptocurrency banking can fill one major gap in the traditional and digital banking spheres, which are international money transfers. Transferring money between countries via blockchain massively reduces the associated costs of the transfer and allows for the money to be sent much more quickly than is possible with traditional banks. Both businesses and individuals sending money to their home country for their families stand to benefit greatly from this, as globalization increases the number of international money transfers.